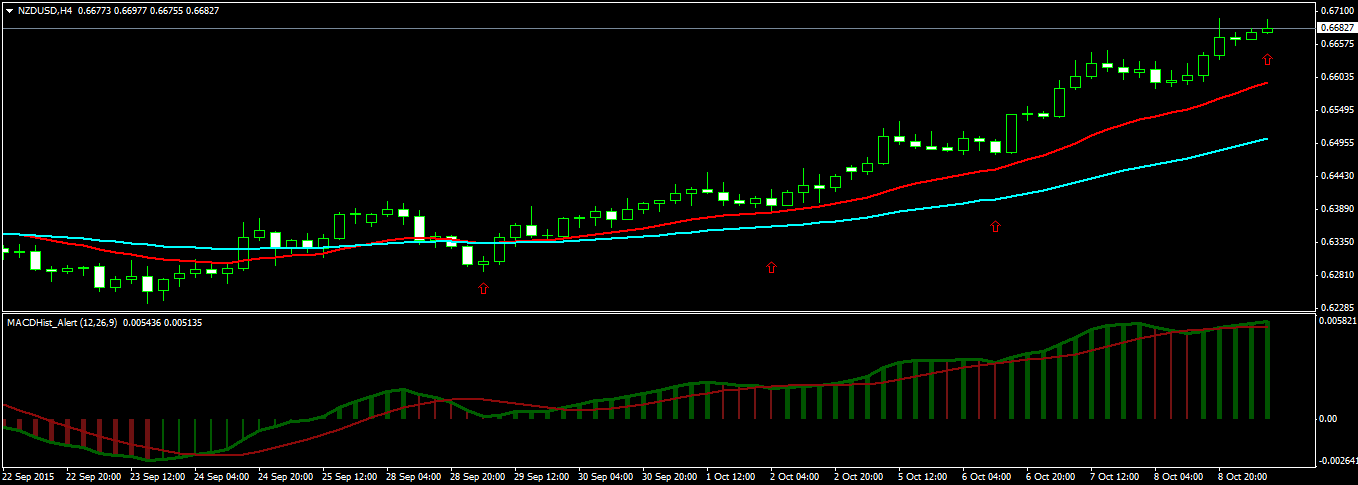

NZDUSD pair moves slowly and steadily unlike GBPUSD and EURUSD which can make fast moves and astonish you if you are not an experienced trader. NZDUSD trend can continue for many days so don’t expect a quick swing trade when you trade this pair. In this post we are going to analyze a recent NZDUSD swing trade that made 200% in 8 in 8 days. Take a look at the following chart.

In the above screenshot you can take see a nice uptrend on NZDUSD H4 chart that lasted around 8 days. We make the entry just above the first red arrow. The entry is at 0.63049 and the stop loss is 0.62849. The risk is 20 pips. Suppose we have $1000 in our account. We can open the position with 0.1 lot which will give us a risk of 2% or we can open the position with 0.2 lot which gives us the risk of 4%. Everything depends on our risk appetite. We plan to be aggressive. So we open the first position with 0.2 lot. If the stop loss is hit we lot $40 which 4% of the account equity.

We open the second position at 0.63959 and move the stop loss to 0.63800. Risk is 15 pips. In case the stop loss gets hit, first position is in profit of 76+76=152 pips so if we lose 15 pips we end up with a profit of 137 pips. We open the second position with 0.2 lot once again. This is a risk free trade. If the stop loss gets hit we lose 30 pips so our net profit will be 122 pips.

We open the third position just above the third red arrow at 0.64820 and move the stop loss to 0.64720. We open the third position with 0.3 lot. We close all the positions just above the fourth red arrow at 0.66984. The profit for first position is 788 pips or $788. The profit for second position is 600 pips or $600 and the profit for the third position is $432. So the total profit is $1820 or 182%. So we are pretty close to the 200% return. If you can learn how to manage the risk you can make high returns.

In the beginning when we had opened the first position, the risk was 4%. We are comfortable with this risk level. You could have opened the first position with 0.1 lot and kept the risk at 2%. After that the second position and the third position were risk free trades. Even if the stop loss would have been hit we would have ended in profit.