If you have been regularly reading my blog, you must have understood by now my trading strategy. My forex trading strategy is simple. I focus on risk management and look for a trade that has a very small stop loss with a big take profit target. In this post I am going to discuss a recent USDCAD short trade that made 300 pips profit with a small stop loss of 10 pips. This gives a Reward/Risk of 300/10=30:1. Did you read the post on GBPUSD sell trade with a stop loss of 10 pips and take profit of 300 pips.Take a look at the following screenshot!

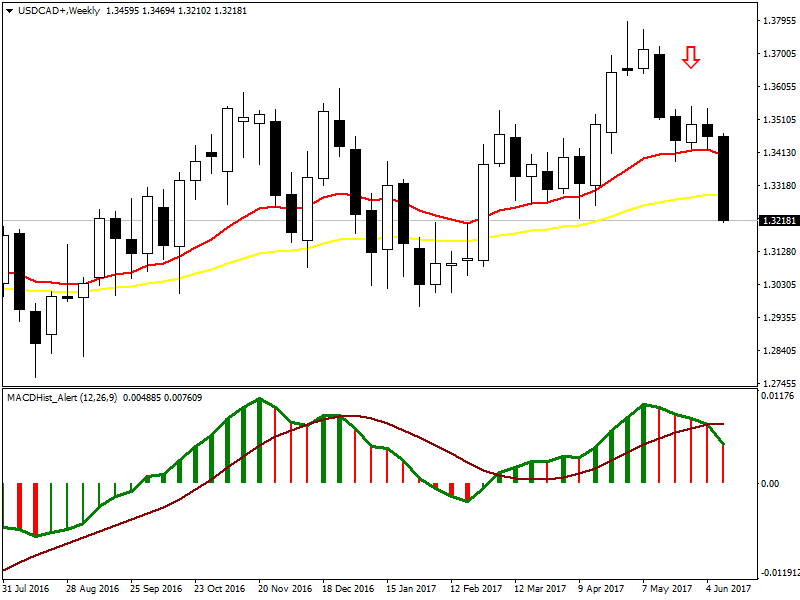

In the above screenshot can you see the up red arrow? This is the entry candle. This is the USDCAD Weekly chart. You can see in the above USDCAD Weekly chart, MACD is in a downtrend. The high of the entry candle is 1.35461. I placed a pending sell limit order with entry price of 1.35320 and stop loss of 1.35420. This gives a stop loss of 10 pips. So my risk is only 10 pips. Now looking at the weekly chart, I fix the take profit target to be 300 pips.That is it. I don’t need to look at the chart again and again. I have done my analysis and placed the pending limit order. Now the trade is set and forget. Did you download your Top Shelf Magazine this month issue? You can read this magazine free.

There are three possibilities. The first possibility is the stop loss getting hit. If this happens, I will lose 10 pips. The other possibility is price moved down but fails to hit the take profit target. In that case, I can close the trade with a take profit target of let’s say 200 pips instead of 300 pips. The other possibility is the take profit target getting hit. So the probability of losing the trade is 1/3 and the probability of winning the trade is 1/3 while the probability of not losing the trade and not winning the trade either is also 1/3. DId you read this post on EURUSD 1-2-3 pattern trade? Take a look at the USDCAD H4 chart below.

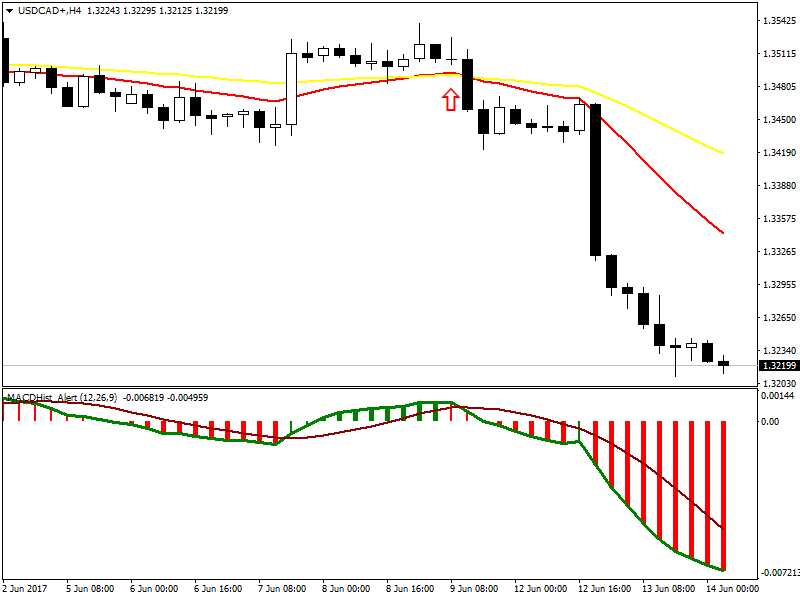

Take profit target has been fixed at 300 pips. As said above, I don’t need to look at the charts again and again if I have done my chart analysis. However I have marked the entry point with a red arrow in the above USDCAD H4 chart. You can see price broke out in the down direction and the profit target was easily hit. This was a trade with an excellent Reward/Risk 30:1. Watch this millionaire forex trader video interview.

I take risk management very serious. Let’s discuss why Reward/Risk is very important. In trading there is no guarantee that you will win every trade. Suppose you can win only 50% of the trade. What this means is that in 10 trades on average, you will win 5 trades and lose 5 trades. Suppose you have a stop loss of 10 pips and take profit of 10 pips. This gives you a Reward/Risk of 1:1. In 10 trades, you make 50 pips and you lose 50 pips so your net profit is 0 pips. Read this post on NZDUSD swing trade that made 200% return in 8 days.

Now suppose we have a trading system that has a stop loss of 10 pips and take profit of 20 pips. In this case your Reward/Risk is 2:1 and in 10 trades you make 100 pips and you lose 50 pips so your net profit is 50 pips. Suppose we further improve our trading system and now we have a stop loss of 10 pips and take profit target of 50 pips. In this case the Reward/Risk is 5:1. In 10 trades, you make 250 pips and you lose 50 pips so your net profit is 200 pips.

Suppose you have bee able to improve your trading system further and now you have stop loss of 10 pips and take profit of 100 pips. In this case your Reward/Risk is 10:1.In 10 trades, you will make 500 pips and lose 50 pips so your net profit is 450 pips. You can see by increasing the take profit you are able to increase your net profit. Now suppose you have further improved your trading system so much that you have a stop loss of 10 pips and take profit of 200 pips. In this case the Reward/Risk is 20:1. In 10 trades, you lose 50 pips and you make 1000 pips so your net profit is 950 pips. Watch this video on how I made 417 pips in 1 day.

By now you must have understood that Reward/Risk is a very important matrix. You should look for trades that have a high Reward/Risk (R/R). As shown above you don’t need to be a rocket scientist to succeed. You just need experience and healthy dose of discipline. Keep the stop loss as small as possible and take profit target big. You can do this by analyzing the weekly and daily chart. After that use your common sense. You just need a winrate to 50% to make 1000 pips. Of course with experience your winrate will increase further.Watch this video on how I trade my favorite candlestick patterns.

Suppose you are able to achieve a winrate of 70% on average. In this case, in 10 trades on average you will win 7 trades and lose 3 trade meaning you will make 1400 pips and lose 30 pips. So your net profit will be 1370 pips. This is how you are going to develop your trading system. Just focus on risk management.I use Candlestick patterns a lot in my trading. Candlestick patterns are very important when you make the entry and exit decisions. Watch this video on 3 candlestick pattern tricks that can improve winrate. USDCAD is a highly volatile currency pair. So always make sure that your risk is small in every trade. 1 pip on a standard lot is equal to $7 on USDCAD. So a risk of 10 pips on a standard lot is $70. 300 pips with 1 standard lot is equal to $2100.

You should trade a portfolio of 10-20 currency pairs. Never ever risk more than 2% on a single trade. When you have a trade open, first wait for it to go into profit Once you have the trade in profit, move the stop loss to breakeven. Now you can open another trade. Once again wait for the trade to go into profit. Once it goes into profit, move the stop loss to breakeven. Now you can open another trade. This is how you should trade. Always take risk management very serious.