EURUSD had been uptrending for the last few weeks. EURUSD gained more than 1000 pips. But on Monday, EURUSD started falling and it has now fallen around 300 pips. Asset markets were jolted into life on Tuesday morning following dovish comments by an executive member of the European Central Bank (ECB).

Euro zone bond yields fell and the single currency lost over 1 percent against the dollar in the morning session, after Benoit Coeure, a member of the ECB’s Executive Board, hinted that the central bank is ready to “front-load” its current quantitative easing (QE) program.

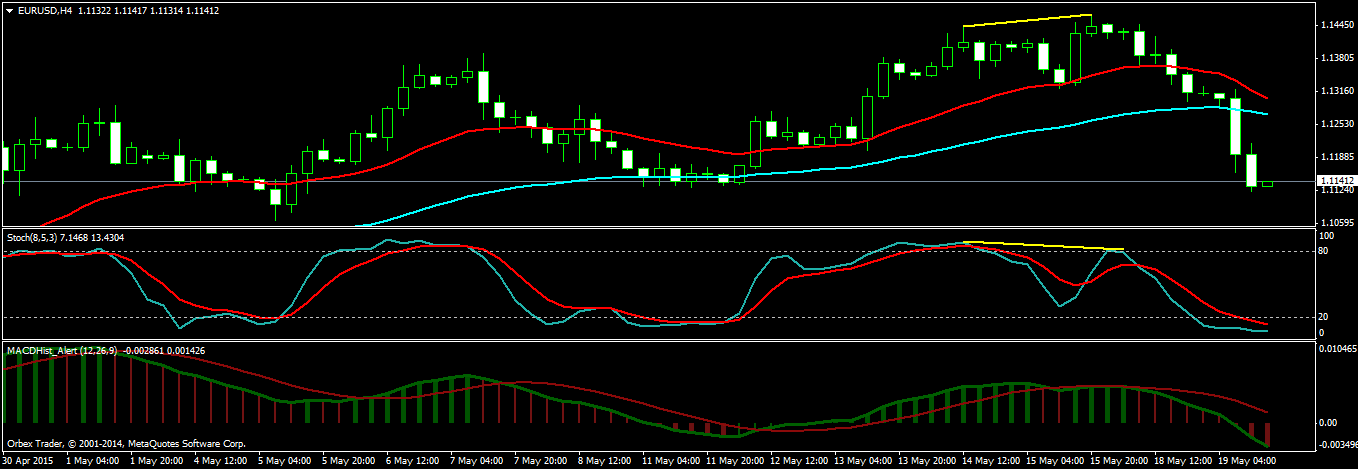

You can see a strong bearish divergence pattern appearing on the EURUSD H4 chart. This bearish divergence appeared at the end of Friday and was confirmed on Monday. Since then EURUSD has fallen around 300 pips. But we believe this is a retracement and soon EURUSD will start moving up again.

The most important thing that you should know about EURUSD is it only moves big when ECB wants it to move otherwise it keeps on ranging. So when today ECB issued the statement that it will start increasing the purchase of assets also known as Quantitative Easing (QE) in terms of technical terms, it compelled EURUSD to start falling. When EURUSD falls so does GBPUSD also falls.