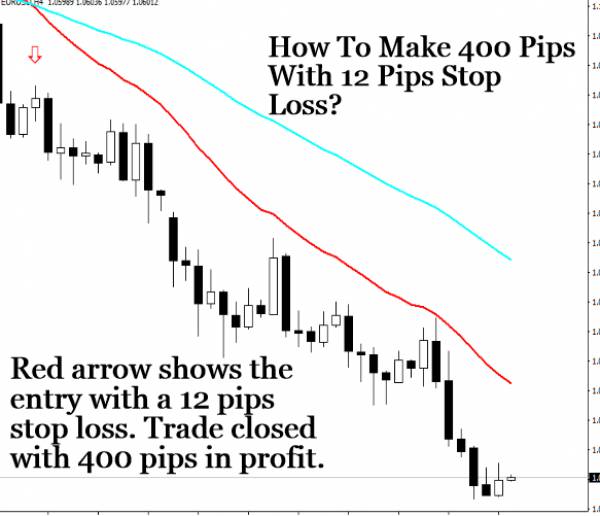

In this post we are going to discuss in detail a recent EURUSD sell trade that made 400 pips with a small stop loss of 12 pips. If you have been reading our blog posts, then you must by now be very clear about our forex trading strategy. We believe in using a very small stop loss in catching the big moves in the market. There is no point in opening a trade with a stop loss of 30-50 pips when you can open a trade with a stop loss of 10-15 pips and make 100-500 pips. We believe in trading naked. Naked trading only means trading without any indicators solely based on price action. Price action is the best leading indicator. Read the post on a USDJPY naked trade that made 1200 pips. Take a look at the screenshot of the recent EURUSD sell trade that made 400 pips with a small stop loss of 12 pips.

This EURUSD sell trade was opened next week after the US Presidential elections. EURUSD first went up on the expectation of Hillary Clinton winning the US Presidential Elections. Then when Donald Trump won, EURUSD starting falling strongly. Why? USD started appreciating strongly. This explains the strong downfall of EURUSD. Now if you have been reading our blog posts, we use H4 candles for opening new trades. Our aim is always to look for low risk entry. EURUSD has a tendency to range a lot and only move on some big breaking news. This big breaking news this time was the upset win of Donald Trump in the US Presidential Elections. You should keep this important fact in mind when trading EURUSD. Read the post on how EURUSD moved up 400 pips in 2 hours and then fell down 200 pips the next hour.

In the above screenshot, you can see the red down arrow just above the H4 candle that was the buy signal. After losing a lot, we started using candlestick patterns in an unconventional manner. Traditional candlestick patterns are no longer working and if you want an edge than start trading in an unconventional manner. The most important thing is risk management. You should take it very seriously. You should never risk more than 15 pips on a single trade. You should write this risk management rule in stone in your trading rules book. Download FREE this month copy of the Top Shelf Traders Magazine.

In the start when we started trading, just like other traders we never took risk management seriously. Sometimes we would open the trade with a 50 pips stop loss. Sometimes even with a 100 pips stop loss. But after losing a few times, we started taking risk management seriously. We fixed a limit of 50 pips for a trade. We decided that we should never risk more than 50 pips. This continued for a few months. After each trade we analyzed it. We realized that we were risking more than we need to. So we reduced the risk per trade to 30 pips. After a few months we reduced it to 20 pips. Today we believe 20 pips to be too big too. We now only open trades with 10-15 pips stop loss.

Now pips don’t give you the full picture. The other part of the risk management rule is we never risk more than 2% of the account equity at any time. We make sure that our account risk never exceeds 2%. Suppose we have $10K in our account as equity. We risk only 2% of the account equity at any time. When we open the trade with 10 pips stop loss, position size will be 2 standard lot. This translates into a risk of 2%.

You should have got our point by now. Risk management is the most serious thing in trading. Never risk more than 2% of the account equity at any time. This risk management rule should be written in stone in your book of trading. When you will win big moves in the market, you will see that even losing 1-2 trades will never hurt your account.

The second rule that you should have in your book of trading is never overtrade. Always make sure you only open 1 trade in 1 day. Never break this rule also. When you become very experienced you can open more trades. But before you open a new trade, make sure that you have made the first trade breakeven. This ensures that your account risk never exceeds 2% at any time. In nutshell this is what our forex trading strategy is.

Today more and more trades are being opened using algorithmic trading systems. If you want to take your trading to your next higher level, you should learn some coding. You should learn how to code your own EAs and indicators using MQL4 and MQL5 languages. You should also learn R and Python and Machine Learning. The days of manual trading will be over in the next few years. Did you witness GBPUSD flash crash when GBPUSD dropped more than 1400 pips in just 1 minute. That flash crash was caused by a rogue algo. Nobody could expect it. Many traders got their accounts blown on that day. Only an algo can monitor the market 24/5. If you are interested, you can take a look at our MQL5 Programming Course in which we teach you how to code your EAs and indicators using MQL5. We also introduce you to fuzzy logic and how you can use it to develop EAs and Indicator. You should also read the post on how to use fuzzy logic in trading.